Generally speaking, there are different types of forex market analysis that will be able to work out in anticipation to your own platform. Overall, there are many categories that can work towards providing the proper analysis towards identifying good trading practices, and most people work according to it.

There are three different areas of analysis for forex market analysis, and they are;

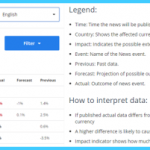

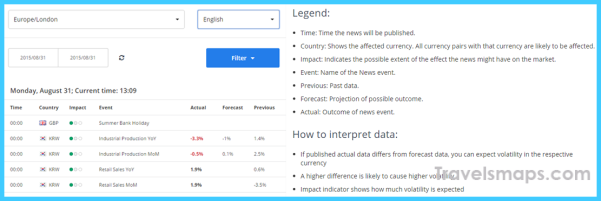

Fundamental: – The fundamental center about forex trading is the interest rate of the currency. There are a lot of other fundamental factors like the GDP or the Gross Domestic Product, manufacturing, installation as well as the economic activity and growth. However, these are the fundamentals, and the fundamental releases are not only good, but they are also of strict importance as they will be able to affect the entire interest rate of the country and its currency. If you go to the fundamental releases, you will realize that it can also affect the future movement of interest rates. Therefore, this is a very important category that needs to be taken into consideration when undertaking forex market analysis.

The Different Types Of Forex Market Analysis Photo Gallery

Technical: – The technical analysis of forex will be included in mind the pattern in the history of pricing, whereby you determine the higher probability as well as the entry and exit strategy. Technical analysis for forex is amongst one of the most widely used systems of analysis. Since forex has been mostly used for the liquid and the commodity markets, you would find that the movement is dependent upon certain trigger features. It can provide you with hidden clues about the current supply and demand. If you go through such behavior and pattern, you will realize that there are a lot of trendy things that can be obtained through this price chart.

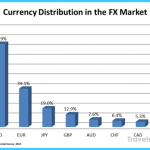

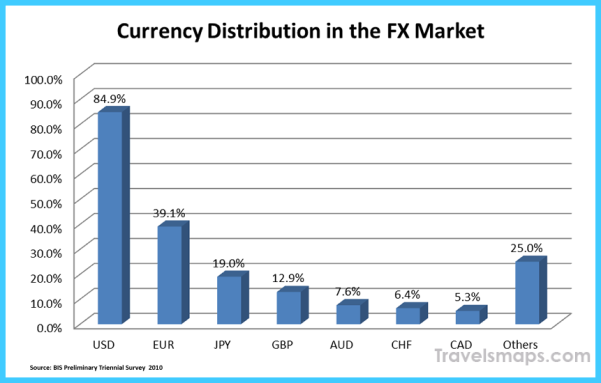

Sentiments:- The sentiment of the forex also happens to be a very important form of analysis, and it is overwhelmingly positioning itself to work towards the vast majority of the trading community. There is a large pool of people willing to trade that they have already purchased, and there are also prospective buyers that would want to become sellers in the future. One has to understand when there would want to close of the trade and when they would want to open it up all over again. It is for this very reason that the vulnerability of the USD is not taken into consideration in case there is a buyback feature as it happens to be very stable part of the global currency phenomena. However, one has also got to realize that selling out on the trades as well as looking into the turnaround feature of the buyers is also essential things that need to be taken into account.

Conclusion: –

If one is to undertake strict forex market analysis, they have got to realize that this is a product that is amongst the best trading commodity the market, so much so that it can provide hefty returns if everything is done correctly.

Maybe You Like Them Too

- Cheap Bus Tickets Guide: Budget-Friendly Road Trips

- Best Travel Backpack Guide: Choosing Your Perfect Fit

- We Travel Chronicles: Tales from the World’s Roads

- Travel Gear Guide: Essentials for Every Adventure

- Hotel de Paris Escapes: Luxury Stays Await