Complex trading terminology is not something to be afraid of. It is something which needs to be embraced, so much so that you do not feel any kind of intimidation when people start making use of it. This is the reason why you need to understand the basic tenements of grid trading strategy.

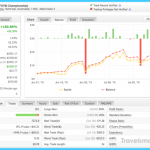

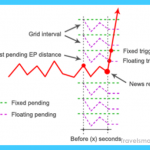

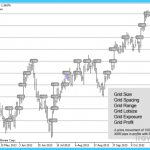

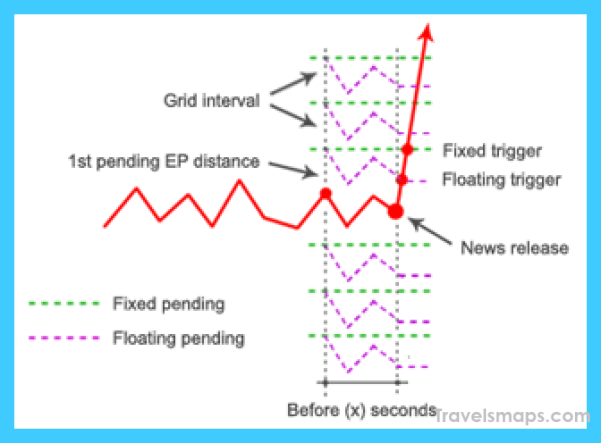

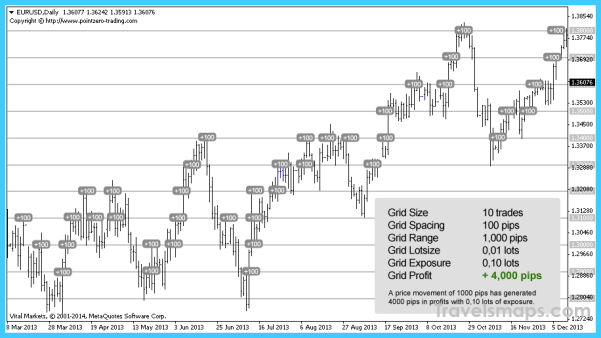

Well, in the grid trading strategy, you would first have to establish the grid system, which is basically establishing a size able to use for your trading needs. The strategy would be based upon whether you are going to be using 50 pips or 100 as the size of the grid, as well as the gaps between the grid lines. Once you have been able to establish that particular feature, then you need to purchase and sell the same currency at the same time without any kind of hiccups.

What is the grid trading strategy? Photo Gallery

The grid trading strategy does not take any positive or negative direction, so much so as we do not consider ourselves blindly back the current direction of the market. Since we are not looking into any kind of direction that the market is heading, we are going to be purchasing the same kind of currency as well as selling them. If the market will start moving in our direction, and you start hitting the grid line, then you would be able to rake in profits depending upon the positive transaction. You would also have to leave out on the transaction which is negative, and afterwards, you would be able to simultaneously purchase and sell at that same level. This process is to be repeated constantly until all the transactions happen to get into a positive grid or pattern, and when you happen to reach the grid line.

However, what is different in the grid trading strategy is the fact that it does not make use of any kind of stops, and that is primarily because they are always hedging your trades as you continuously purchase and sell at the same time. Due to the size of the grid, you would not be able to execute all the trades each day; however, if you feel like choosing a different size of the grid which will be suitable to your trading pattern, you would end up becoming more active. By making use of the strategy, you do not require any active use of any chart, although it can be easily automated with the help of any software.

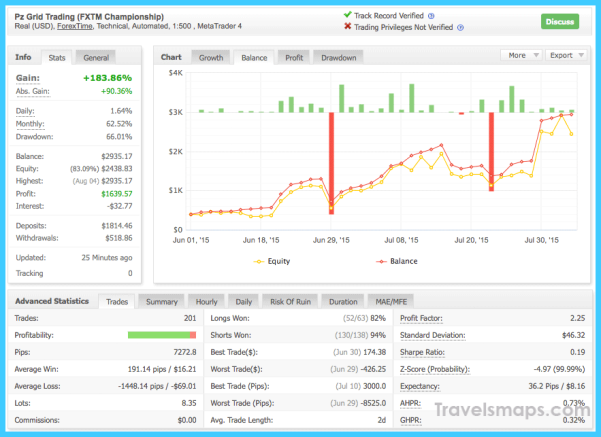

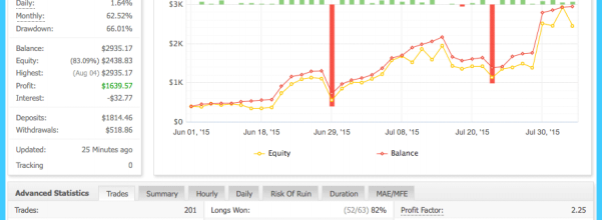

However, a negative aspect in association with the grid trading strategy is that if it happens to be a very strong trading market, then you are going to get a lot of drawdowns. It is always better for you to understand that you need proper risk management system in place so that you do not find yourself getting beaten down in your strategy. It is also important for you to not shift your mindset very frequently in case you are coming across a lot of losses. Only by understanding the advantages and disadvantages of the grid trading strategy should you move forward.

Maybe You Like Them Too

- Cheap Bus Tickets Guide: Budget-Friendly Road Trips

- Best Travel Backpack Guide: Choosing Your Perfect Fit

- We Travel Chronicles: Tales from the World’s Roads

- Travel Gear Guide: Essentials for Every Adventure

- Hotel de Paris Escapes: Luxury Stays Await