You probably know about the mainstream banks when looking for a personal loan to fund your travel or vacation plans. However, what most people don’t prepare for is the lengthy and rigorous application and approval process before they get approval for the loan they require.

In addition, you may go through all the rigors only to get denied at the last moment, meaning you have wasted plenty of time and energy and yet have nothing to show for the effort. If you’re considering sourcing a cash advance to top up your vacations savings kitty, here are reasons you should consider turning to a local lender:

1. You can get an advance regardless of your current loan profile

Are you servicing more than three loans? The average traditional bank will be reluctant to extend yet another loan your way. However, local lenders do not consider how many other loans you are servicing, provided that you qualify for the current loan you’re applying for.

2. No appraisals for loans under $100,000

If you’re applying for a loan to get a vacation home, these lenders do not require appraisals to be done unless the value of the loan exceeds more than $100,000. They will not need to inspect the home to make sure it’s in livable condition, which contributes to a quick winding up of the problem.

3. They are easy to work with

As mentioned earlier, conventional lenders have rigorous, rigid procedures to adhere to strictly before your request for a loan is approved or rejected. Even if all you’re doing is applying for a small cash advance to be repaid in just a few months, the process takes so long that you have to think about funding months before you’re due to go on vacation.

However, with local lenders, you just need to have an account and file your tax returns at the bank, and the approval process will begin. You can get your approval in just days.

4. Better chances of approval

Many people find it hard to get bank approval for personal loans, even if they have a solid credit repayment history. This is because over the last few years, banks across the United States have implemented very stringent rules to fulfil before accessing loans.

However, local lending institutions run more efficiently and leniently. Some of them are completely on-line and hence have little overheads, which means they are able to offer loans to people who have less than perfect credit scores or those who are servicing multiple loans.

5. You can get cheaper rates

Once you’ve been denied a personal loan by your bank, you have few options, such as applying for payday loans which have exorbitantly high interest rates as high as 60%. In fact, these rates are so high that some states have completely outlawed such providers.

However, local lenders typically offer more reasonable rates of interest lower than your bank even because they accrue fewer overheads and hence can afford to lower their rates. In addition, if you need larger loans, this can also be arranged with your local lending institution.

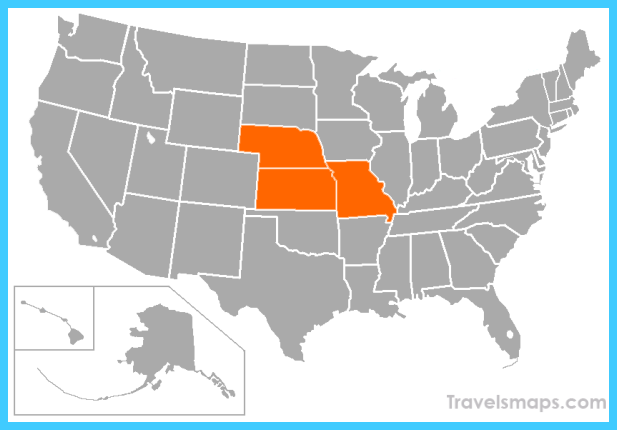

Map of Kansas Missouri Photo Gallery

Maybe You Like Them Too

- The Most Beautiful Cities, Monuments and Attractions for Christmas

- The Best Places To Visit In North America For Christmas

- The Best Travel Destinations For Your Bucket List

- Faro Travel Guide: Map of Faro

- Mumbai Travel Guide For Tourists: Map Of Mumbai