It is now too common to hear that the growth of student loan debt has become like a time-bomb which is always threatening to blow up the US economy. Did you know that the outstanding balance on student loans of the entire nation is now growing at an estimated $3055.19 every second according to the clock that has been developed and introduced by Marketwatch, an education data site? As the pundits and the policymakers debate different ways of tackling America’s $1.2 trillion in the form of student loan debt, the clock that is ticking away constantly is a proof of the growing risk to the economy as well as the student loan borrowers and their parents.

College costs and tuition fees have shot up, there have been cuts to public funding for higher education, stagnant income and a large growth in the population that goes to college and all this could be blamed for the increase in the student loan debt since the last decade. Reports suggest that about 40 million Americans are currently carrying some student loans and around 75% of college students graduate with debt.

College students are not being able to realize their dreams

Due to the overwhelmingly large amount of student loan debt carried by the college graduates, many of them are not being able to buy new homes, cars, initiate their conjugal lie or even carry forward their child-bearing plans. According to the research by the New York Federal Reserve, this is even preventing a boost in the economic growth that could have happened if they could carry out their plans. Only 40% of the borrowers are actually being able to pay down their debt. Hence, this throws light on the worsening situation of the US economy and how an entire generation is getting paralyzed due to the huge amounts of student loan debt burden.

Tips to tackle your student loan debt

Whether you’ve just graduated from school or you’ve already started making repayments on your student loans, these tips mentioned below will help you keep your student loan debt under control. If you’re facing trouble in keeping up with the payments, follow them.

1. Try to know your loan programs: It’s vital for you to keep track of the lender from whom you have borrowed, the total balance that you owe and the current repayment status of each of your student loans. It is only then that you can determine your options for loan forgiveness or loan repayment. In case you’re not sure about all the aforementioned details, you can log into http://www.nslds.ed.gov/. Here you can get the details of the loan amount, the lender, the repayment status and also check whether it’s a federal or a private loan.

2. Know the grace period of the loan: Make sure that different loans have different grace period. This grace period is the time throughout which you can wait after leaving school before you have to send in your first payment. For the Federal Stafford loans, the grace period is about 6 months and for federal Perkins Loans, it is around 9 months. On the other hand, the grace periods for private student loans vary and you have to consult your lender to find out such details.

3. Don’t lose touch with your lender: Whenever you change your contact details or move or change your address, inform your lender right away. If in case your lender needs to contact you and your details are incorrect, it might end up in costing you a bundle. Open and go through each mail that you get on student loans. In case you get unwanted calls from a collection agency, don’t ignore them. Instead talk to your lender as this is the best way to grab alternatives when you were least expecting.

4. Choose the best repayment option: When you are delinquent on your federal loans, the loan payments will be based on the standard 10 year repayment plan. However, if that is going to be tough for you, you can change plans down the line whenever you need to. If you extend your payments beyond 10 years, this can lower your monthly payments but you will end up paying more on interest rates throughout the term of the loan. So, you got to be careful before extending the plan.

5. Don’t panic: Last but not the least, you shouldn’t panic about the state that you’re going through. When you have your lenders by your side and when there are so many repayment options, you should try to take it easy. Forget to panic and instead concentrate on debt repayment.

Just like you can utilize debt consolidation for credit cards , all student loans can’t be consolidated, especially the private ones. Hence, take into account the tips mentioned above to tackle them with ease.

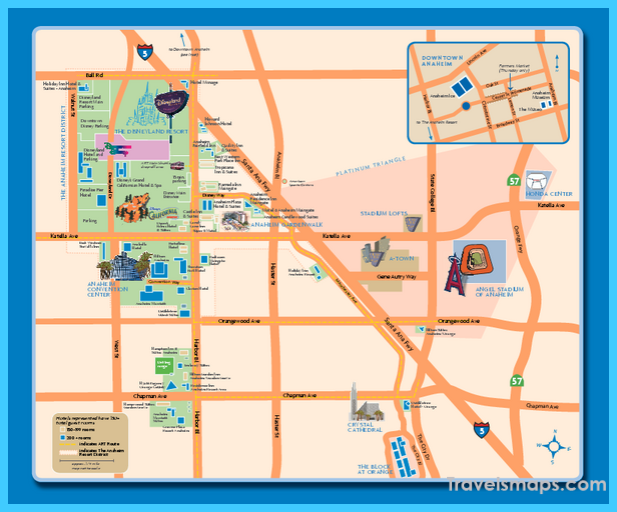

Map of Anaheim California Photo Gallery

Maybe You Like Them Too

- The Most Beautiful Cities, Monuments and Attractions for Christmas

- The Best Places To Visit In North America For Christmas

- The Best Travel Destinations For Your Bucket List

- Faro Travel Guide: Map of Faro

- Mumbai Travel Guide For Tourists: Map Of Mumbai