Life insurance can provide instant cash support for your family in the event something happened to your on your next vacation or business trip. No one likes to think of it but it is good to face the reality of death and do the logical thing by protecting your loved ones with a life insurance policy. Well now that you know that life insurance is a good idea, you should know that getting life insurance for a frequent traveler is not easy. So lets discuss what the companies look for and how to increase your chances of getting covered.

When applying for life insurance one of the common questions is whether or not you intend to travel outside of your home country within the next two years. In most cases this will not cause the company to decline you coverage unless of course the country of destination is on the red list. Because life insurance carriers are great at evaluating risk they have created a list of countries that are very dangerous and are on a high risk list. If you are thinking of traveling to a country that falls in this category, it is very likely that the company will not issue a policy to you. Although there are some people who created lawsuits out of this and one day traveling to these countries won’t be an issue, currently it still is. If you are wondering whether or not your country of travel is on the list feel free to check out the website of US Passports and International Travel department.

The key is to find a company that will not only cover travel abroad but also the country of your destination. Because many companies will simply not offer coverage in the first place. That is why you should work with an independent broker who can shop around with multiple companies and find the one that will provide coverage for you. Once the right company is found keep in mind that you will have to also qualify based on your health and lifestyle. Life insurance companies will rate you based on your age, build, any medical conditions, driving history and even family history. It is also good to note that a life insurance not requiring a medical exam is the ideal if you need coverage fast.

Let’s say you qualify based on your health and you still are not able to get covered with any of the top companies. In that case the last resort would be to try and get life insurance with an organization such as Lloyds of London which will insure risk that nobody else will. Although their policies can be more costly, it is still a reasonable option when getting life insurance is a must. Another alternative could be a travel insurance company that has life insurance policies specifically for travelers in case of an accident. So getting life insurance can be easy for travel if the country is not considered high risk. For all others a little research goes a long way.

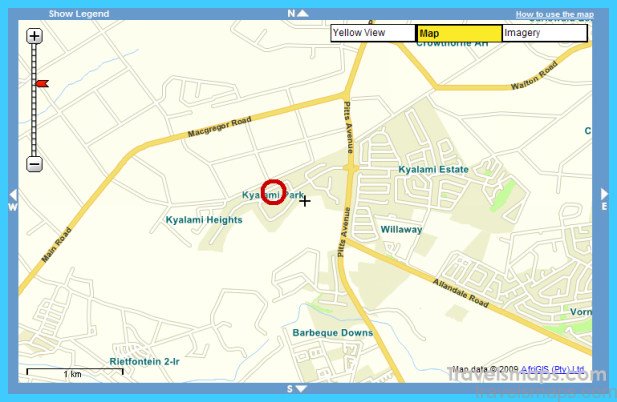

Map of Johannesburg East Rand Photo Gallery

Maybe You Like Them Too

- The Most Beautiful Cities, Monuments and Attractions for Christmas

- The Best Places To Visit In North America For Christmas

- The Best Travel Destinations For Your Bucket List

- Faro Travel Guide: Map of Faro

- Mumbai Travel Guide For Tourists: Map Of Mumbai