For the last ten years, homebuyers in many central European nations have been taking out mortgages denominated in Swiss francs instead of their local currency. They were taking advantage of the low interest rates available for Swiss franc loans, because locally-denominated mortgages were usually offered at double-digit rates. In fact, many banks in nations like Poland and Croatia advised their wealthier customers to take advantage of the Swiss franc mortgages.

It turned out to be a shortsighted decision and a short-lived advantage. When the global economic crisis began in 2008-09, the Swiss franc grew stronger against central European currencies. That meant large payment increases for homeowners in the region who had taken out mortgages based on the franc but had to pay each month in local currency.

This year, things got much worse. In mid-January the Swiss National Bank decided to drop its currency ceiling against the Euro, and within days the franc had risen 20% or more against most central European currencies. Some homeowners have now seen their monthly mortgage payments rise to double or triple what they were paying when they took out the loans, with no sign that the franc’s rising value will drop anytime soon.

The biggest impact has come in Poland, where more than half-a-million Swiss franc-denominated mortgages (37% of all home loans in the country) are held by homeowners. But similar issues are plaguing mortgage holders in Romania (75,000 loans), Croatia (60,000 loans), Serbia, Austria and other neighboring nations. More details will be discussed in this site.

The crisis may wind up being solved, although at a high cost. Hungary has required its banks to convert the problem loans into local currency mortgages at manageable rates, and many other governments may follow suit. The idea has already been floated in Poland, where the nation’s finance minister has also asked local banks to lower their margins and apply the prevailing below-zero Swiss interest rates; some have done so while others are holding out. Polish parliamentary elections will be held later in the year, which will certainly pressure politicians to find a quick solution to the crisis.

Croatia’s prime minister has suggested taking steps similar to Hungary’s, and has already asked his parliament to fix the local currency against the franc for one year to give the government time to find a more permanent fix. Meanwhile, the Romanian government plans to expand an existing debt-relief program for low-income residents, so that it includes those who have Swiss franc mortgages. Serbian officials are meeting to discuss their options.

There are two issues still facing central European nations, even if they eventually all decide to convert mortgages into local currencies. First, those conversions would cost banks a large percentage of their currency reserves; that cost is estimated at more than 3 billion euros in Croatia alone, so bank stability could be a major concern. Second, if the Swiss franc continues its meteoric rise while debates over solutions continue, all bets could be off and the search for an answer to the crisis would have to begin all over again.

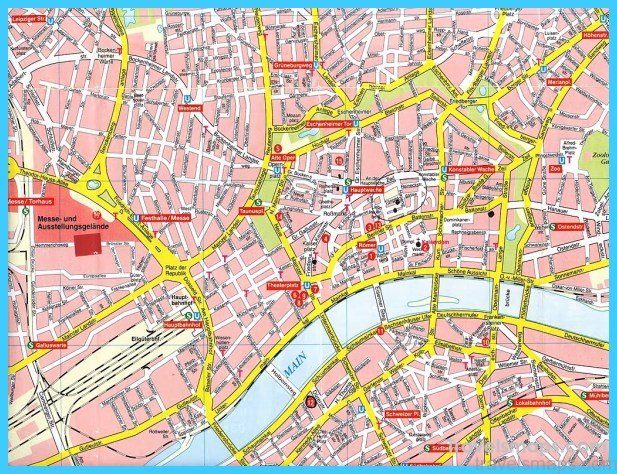

Map of Frankfurt Photo Gallery

Maybe You Like Them Too

- The Most Beautiful Cities, Monuments and Attractions for Christmas

- The Best Places To Visit In North America For Christmas

- The Best Travel Destinations For Your Bucket List

- Faro Travel Guide: Map of Faro

- Mumbai Travel Guide For Tourists: Map Of Mumbai